The story of Venezuelan oil — long a critical axis of the nation’s economy — has entered an unusual new chapter. In early 2026, after the dramatic U.S. capture of President Nicolás Maduro and shifting power dynamics in Caracas, a controversial arrangement emerged: proceeds from the sale of Venezuelan crude are reportedly being held, at least partly, in bank accounts in Qatar under U.S. oversight. What might seem like a technical financial maneuver in fact reveals geopolitical strategy, legal ambiguity, and competing visions of economic recovery — and the tale is far from settled.

A New Revenue Stream from Venezuelan Oil?

Since the ouster of Maduro, the U.S. has sought to harness Venezuela’s massive oil reserves — among the largest in the world — as part of a transitional plan for the crisis-stricken nation. According to recent reporting, the Trump administration has brokered the first sale of Venezuelan oil under this new scheme, generating roughly $500 million. These proceeds are not being immediately funneled into U.S. coffers or returned to Venezuela through traditional channels. Instead, a significant portion which is controlled by the U.S. government has been deposited into accounts in Qatar, chosen because of its perceived neutrality and ability to facilitate the flow of funds without immediate seizure by other creditors or legal claimants.

This account in the Gulf state, which may involve established Qatari financial institutions, is part of a broader mechanism designed to manage and eventually disburse Venezuela’s oil revenues under U.S. supervision. Administrators justify this approach by pointing out that Venezuela, under heavy sanctions for years, lacks unfettered access to the global banking system. Placing the funds in a middle ground — a third-party jurisdiction — is intended to preserve liquidity and prevent interference from bondholders, litigation claimants, or geopolitical rivals who might otherwise claim stakes in Venezuelan assets.

From Qatar to Caracas: Expectations and Logistics

Reports suggest that some of the funds in the Qatari account are already moving back into Venezuela through local financial channels. According to sources close to the situation, four Venezuelan banks were notified that they would receive approximately $300 million from revenues held in the Qatar account, a move aimed at supplying foreign currency to Venezuela’s struggling private sector so that companies can import materials and cover basic obligations.

This transfer — channeled through private banks rather than routed directly to the Venezuelan central bank — appears to serve multiple purposes: starting to replenish hard currency in the domestic economy while keeping the operation under international supervision. U.S. officials have suggested that priority will be given to essential imports, such as medicine and food, as well as public payrolls.

The Political and Legal Undercurrents

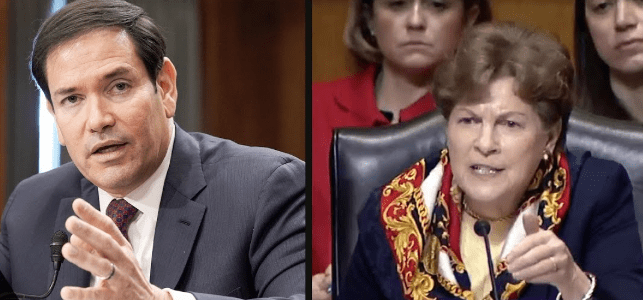

Behind the mechanics of oil sales and arbitrage sit deep legal and political questions. Critics, including legal experts and some lawmakers, argue that there may be no clear constitutional or statutory basis for the executive branch to take control of and redirect proceeds from the sale of foreign natural resources, even when those resources are tied to U.S. intervention abroad. One prominent voice has noted that U.S. policy traditionally dictates that receipts of government funds must be deposited into the U.S. Treasury and subject to congressional appropriations — a requirement that could be in tension with offshore accounts and discretionary disbursement.

Additionally, concerns have been raised about transparency and oversight. Some U.S. congressional voices have questioned whether funds held outside the regular accountability framework of the Treasury and federal appropriations process might lack sufficient checks and balances. In this light, even if the strategy is aimed at stabilizing Venezuela and signaling goodwill, it also generates litigation risk and political pushback domestically.

Regional Geopolitics and Qatar’s Role

Why Qatar? On the surface, Doha’s role as a financial intermediary in this scenario is practical: it sits outside the most punitive sanctions regimes, operates large and relatively flexible banking sectors, and is seen by some as a neutral intermediary in contentious international financings. But geopolitically, Qatar occupies a complex position. It maintains relationships across competing global powers and has experience hosting mediated settlements and financial undertakings in its sovereign wealth and banking sectors. The choice of Qatar also illustrates how smaller states can become crucial nodes in global financial architecture when traditional channels are blocked by sanctions or diplomatic estrangement.

Transparency and the Path Ahead

Not all observers are comfortable with the process. Skeptics worry that prolonged reliance on opaque offshore holdings could open doors for corruption, rent-seeking, or misuse — particularly in a country like Venezuela, where weakening state institutions and entrenched patronage networks have long distorted governance. If oil proceeds are not subject to robust audit and public visibility, questions will inevitably arise about who benefits and how decisions are being made. Additionally, the choice of intermediaries — including private trading firms with complex compliance histories — could further complicate public trust in the scheme.

Simultaneously, U.S. and Venezuelan interim authorities have been negotiating monthly budget reports and spending plans, suggesting an evolving framework for gradually returning money to Caracas in a managed and accountable way. Yet the shape of that framework — and the extent to which it will satisfy congressional oversight, international law, and Venezuelan public expectations — remains unresolved at the point of this writing.

The Money’s Future Still Unwritten

As this story develops, pay attention not just to how much oil is sold or how many barrels are pumped, but where the money ends up, who decides its destiny, and what legal and political structures govern its use. The Qatar account may be an interim waypoint — but its existence highlights the broader uncertainties of international finance, sovereign authority, and post-conflict reconstruction in a highly polarized world. Whether this mechanism becomes a blueprint for future interventions — or a cautionary tale of opaque fiscal engineering — is a question still very much in play.

Leave a comment